Introduction

This section should be completed by companies that are responsible for product creation which includes design & development, manufacture and distribution of their own/private label brands.

Licensees:

Companies that are licensees (holder of a license to use a trademark) and are responsible for product creation as per the previous paragraph may also complete this section to evaluate their own sustainability practices and performance.

Licensors:

Companies that make product creation decision for licensees to execute should include those licensee business streams in their own Brand section reporting.

Companies that request their licensees to complete their own Higg BRMs should exclude those licensee businesses from their own Brand section reporting to avoid double counting.

Steps in the OECD due diligence process that are addressed in the Brand – Environment section

Step 1. Embed Responsible Business Conduct into policies & management systems

Step 2. Identify & Assess Adverse Impacts in Operations, Supply Chains and Business Relationships.

Step 3. Cease, prevent or mitigate adverse impacts

Step 4. Track Implementation and Results

Step 6. Provide for or cooperate in remediation when appropriate

Brand (Environment)

Product

1.1 Which of the following primary material categories are used in your products?

- Cellulosic Textiles (man-made)

- Cotton Textiles

- Foam

- Fur

- Insulation Materials (natural or synthetic)

- Leather

- Plastics (synthetic or bio-based)

- Metals

- Rubbers/Elastomers

- Synthetic Leather

- Synthetic Textiles

- Wood-Based Materials (e.g., cardboard, cork, wood)

- Wool

- Other textiles

Intent of the question

This question intends to assess whether your company has a way of accurately accounting for and tracking of the primary materials used in the products you sell. This information supports the company’s understanding of the environmental risks and impacts associated with their material use.

Technical Guidance

Scope of this question

- Materials provided are aligned with the Higg Materials Sustainability Index (MSI). For a list of definition of materials please login to Higg.org to access the Higg MSI, Example Materials.

- Definition of Foam: A solid “open cell” or “closed cell” foam material commonly used in packaging and footwear. Includes EVA, PE, and PU foam. More information can be found through Higg MSI on Higg.org platform

- Product categories: The key users are companies that sell apparel, footwear, textile products and hard goods. However, with the exception of the questions around specific materials, the tool enables companies regardless of product category to evaluate their sustainability performance and provides recommendations on integrating sustainability into organizational practices.

- Primary materials are defined as the key materials used to make the final product. Primary materials are all the materials that, when totalled, represent at least 80% of the total material usage.

- The primary materials used in the production of your products, excluding packaging and trims, within the reporting period.

Includes nominated and non-nominated (chosen by your supplier) materials that are used in your final product.

Definitions

Materials inventory: Information that has been documented on the material types and volumes used by the company. This information can be consolidated from purchase orders, contracts, sourcing specifications, credible data collected from Cut Make Trim suppliers/sourcing agents/nominated fabric mills, or by using information from product legal declarations/care labels.

If the material is sourced from improved (sustainable) sources, such as organic cotton or recycled polyester, this should be noted in the inventory (so long as these claims are verifiable and credible).

Nominated vs non-nominated suppliers:

Nominated suppliers are those suppliers with a direct or agreed business arrangement – for example, if a brand has agreed with a fabric mill to purchase a specific amount of fabric that can be used by Cut Make Trim (CMT) suppliers. Alternatively, a brand can have an agreed list of ‘allowed’ producers that a supplier may source from – for example, for trim, packaging, dyestuffs, fabric, etc., there may be a list of ‘endorsed’ suppliers that a direct supplier is allowed to negotiate with or buy from.

Non-nominated supplier will be any supplier below the CMT suppliers without a direct business relationship to, or agreement with, your company, and who is not specifically identified as a recommended/required supplier.

Primary materials are defined as the key materials used to make the final product. Primary materials are all the materials that, when totalled, represent at least 80% of the total material usage.

Packaging: Materials used to protect or wrap goods.

Trims: Trims and components are the other components (other than fabric) that make up the rest of the garment. This can include but is not limited to buttons, threads and zippers (apparel examples) or eyelet, buckle, cord and EVA padding (footwear examples).

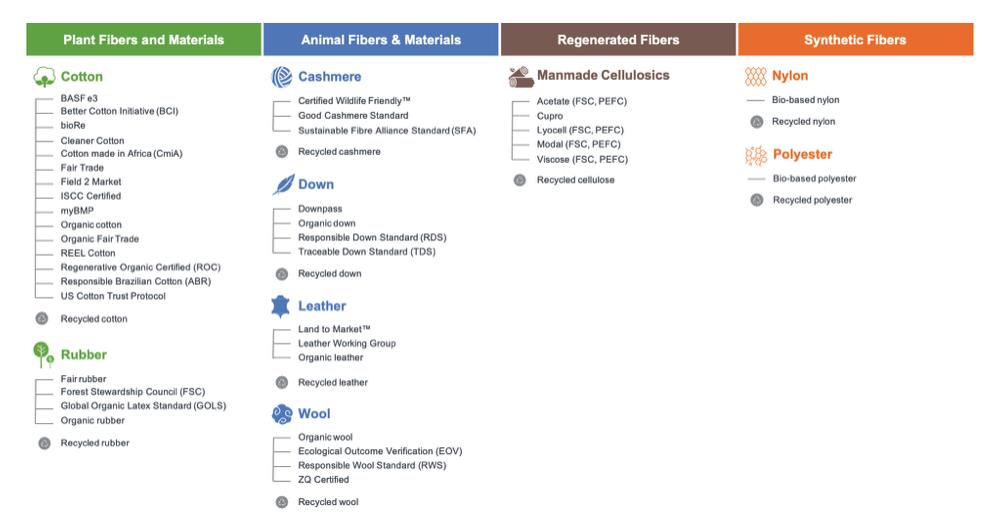

How to calculate primary materials

There are several ways that companies can create an inventory of the types and volumes of materials. Three examples are listed below. The level of accuracy increases from #1 to #3.

- By reviewing material projections provided to the Tier 2 material manufacturer, either from the brand or on their behalf by Tier 1.

- By reviewing Purchase Orders from Tier 1 for Cut, Make, Trim, or brand in some cases, to the Tier 2 material manufacturer.

- By reviewing production, shipping, and receipt documents to corroborate the actual quantities.

Answer options

- To answer ‘yes’ to this question, >75% of your total volume of primary materials has been recorded in an inventory.

- To answer ‘partial yes’ to this question, 25% to 75% of your total volume of primary materials has been recorded in an inventory.

- To answer ‘no’ to this question, <25% of your total volume of primary materials has been recorded in an inventory.

Helpful Resources

- Companies that do not have a materials inventory yet, can start by using the data collection sheet (material use tab) to record their types and volumes of materials used in their products.

- Some tools to utilize when assessing the environmental impacts of your materials could include: a Life Cycle Assessment, the Materials Sustainability Index (MSI), http://msi.higg.org/page/msi-home or other credible environmental impact assessment.

- Textile Exchange offers a standardized approach to converting product, fabric, and yarn used back into fiber for a consistent baseline measurement within and across companies.

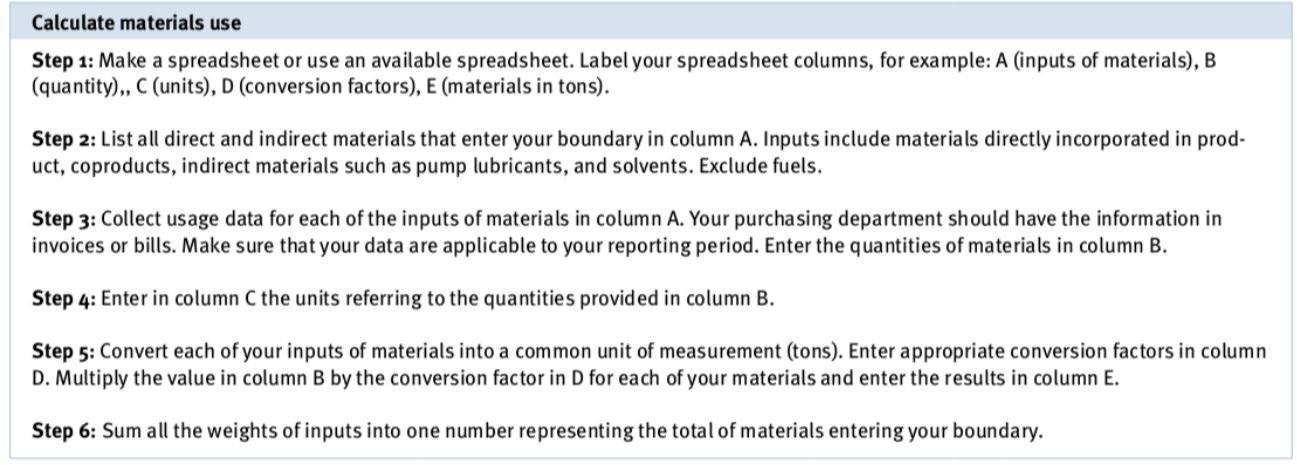

- UNIDO/UNEP RECP Programme’s Enterprise level indicators for Resource Productivity and Pollution Intensity: 6 steps in order to calculate materials use.

This question will populate a list of environmentally preferred materials based on your selections in question 1. Please select one or more of the options that are populated for you.

- Cellulosic Textiles (man-made)

- Cotton Textiles

- Foam

- Fur

- Insulation Materials (natural or synthetic)

- Leather

- Plastics (synthetic or bio-based)

- Metals

- Rubbers/Elastomers

- Synthetic Leather

- Synthetic Textiles

- Wood-Based Materials (e.g., cardboard, cork, wood)

- Wool

- Other textiles

Intent of the question

This question is intended to assess whether your company sources materials that have reduced environmental impacts compared to their conventional counterparts. The majority of product-related environmental impacts result from: raw material extraction, growing, and harvesting; as well as from processing, dyeing, and finishing of the materials. Source: Quantis’ 2018 Environmental Impact of the Global Apparel and Footwear Industries study

Technical Guidance

Definitions

Preferred: The Higg BRM definition of “preferred” aligns with Textile Exchange, which defines a preferred fiber or material as: one which results in improved environmental and/or social sustainability outcomes and impacts in comparison to conventional production.

Attributes: Refers to material types that have a verifiable and credible claim that improve environmental sustainability.

Two resources available to explore preferred materials options with reduced environmental impacts are:

Companies can significantly decrease the environmental impacts of their materials use through the following actions:

- For the material you are currently using, consider switching to a material type with a lower impact. Examples include using: recycled content, organically grown or chemically optimized fibers, and no- or low- water processes. When you are switching between materials please ensure through analysis and research that you are not transferring impacts to another life cycle stage.

- Once you have selected the material that will be used, you can explore lower impact processing options of that particular material. The Higg MSI and Textile Exchange’s Preferred Materials List can be used to review process options that will reduce your environmental impact.

Answer options

- To answer ‘yes’ to this question, >75% of your total volume of materials are either environmentally preferred or have an environmental attribute.

- To answer ‘partial yes’ to this question, 25% to 75% of your total volume of materials are either environmentally preferred or have an environmental attribute.

- To answer ‘no’ to this question, you should have documented less than 25% of your total volume of materials are either environmentally preferred or have an environmental attribute.

Helpful Resources

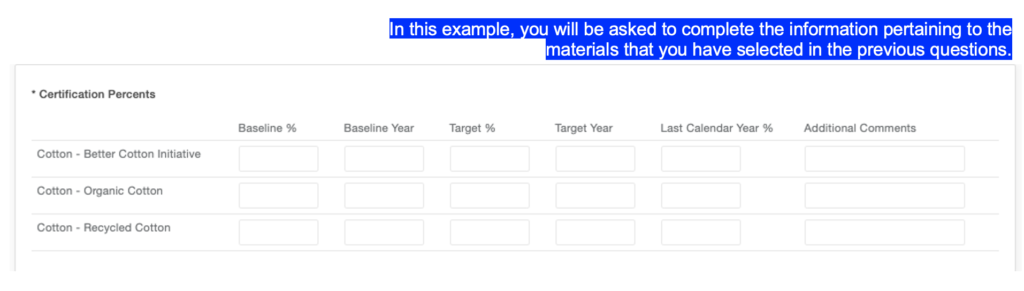

5.1 If you answered yes, please select the applicable environmental attribute for your materials:

Intent of the question

This question intends to ensure that companies are confirming and tracking the materials used which have environmentally preferred attributes/certifications. Developing a progressive sustainable materials strategy will only be possible if a company understands and has visibility of their entire materials portfolio and knows whether environmentally preferred attributes or certifications have been used.

Companies may track sustainable materials as a percentage of that material’s conventional counterpart or as a percentage of the entire materials portfolio.

Technical Guidance

This question focuses on your individual materials, not on your products.

For each environmentally preferred material selected in the previous question, you will be asked to specify which environmentally preferred attribute or certification has been used within the table format.

On the next page you will find a brief explanation on the terms used within the table.

| Type of certification / attribute | Certifications such as but not limited to:

Companies can also use the Higg MSI dyeing and coloration information to choose lower impact dyeing process e.g. solution (dope) dyeing. |

| Baseline % | In order to demonstrate improvements or reductions, it’s important to know what your starting point is. A “baseline %” is a starting point of the initial reporting percentage. This percentage will enable your company to track over time whether you are on track to make progress against your set target(s). |

| Baseline year | The initial reporting year, which you are measuring targets against, is also known as the baseline year (which the above “baseline %” is based on). |

| Target % | A target is a particular goal to be delivered by a company for a specific period. The Target % is an indicator of where you want to be from the baseline %. Target types that are most commonly used are either absolute or normalized. Absolute target addresses the total amount/quantity per year or per month. In the materials context this could be total amount of water used by materials supplier in a year or total amount of kg of recycled polyester use. Normalized target is a comparison of totals or usage against a predefined variable. An example is the amount of water used to produce 100 yards of fabric at a material supplier. In the materials context this could be the quantity per meter of fabric, quantity per unit, quantity per dollar of revenue. Or percent of total polyester usage that is recycled content. It is recommended to use normalized targets when setting materials targets. |

| Target year | The year in which the “target %” has to be achieved. |

| Reporting Period % | The percentage of products which carry end-of-use certifications and/or attributes in the . |

| Additional comments | Any notes or comments to provide clarity to the information you have submitted. |

- Attributes: Refers to material types with verifiable and credible claims that improve environmental sustainability. For example, organic cotton and recycled polyester are attributes.

- Certification: A third party certification program confirm the integrity of the environmentally preferred attributes within the material. Third-party certification programs support a systemic approach to integrate environmental performance in the raw materials. Examples of certification programs include but is not limited to: GOTS, Textile Exchange and Forest Stewardship Council.

Answer options

- To answer ‘yes’ to this question, your company has tracked more than 75% of your entire materials portfolio for environmental attributes or certifications.

- To answer ‘partial yes’ to this question, your company has tracked 25-75% of your entire materials portfolio for environmental attributes or certifications.

- When answering “no” to this question, your company has tracked less than 25% of your entire materials portfolio for environmental attributes or certifications.

Helpful Resources

- Guidance on setting baselines and targets can be found here

- If helpful, a baseline and targets template can be downloaded from this page as well

- Explanation of Scope and Transaction Certificates:

- GOTS

- Textile Exchange

- Policy For Scope Certificates, V2.0

- Policy For Transaction Certificates, V2.0

Intent of the question

This question is intended to ensure companies have a robust understanding of the environmental impacts associated with the use of their products so that they can set strategies and targets accordingly to improve on these identified impacts. This question also intends to support your internal process to identify and prioritize the key environmental risks and impacts holistically across your product portfolio.

Technical Guidance

To answer ‘yes’ to this question, your company must have carried out a product life cycle assessment, life cycle inventory, or analysis / study in the last five years that includes one or more of the following:

- Analysis of environmental risks and impacts based on the manufacturing through to use phase of key product categories.

- Description of the percentage of production or sales the above analysis covers.

- Documentation of materials until processes, which can be collected through bill of materials and production records. Documentation related to the materials used and the finished goods production processes — which can be collected through bill of materials and production records.

- Analysis of specific opportunities within the stages of product design & development and consumer use phase to address environmental risks or impacts.

Note: Any analysis, assessment, or study should be backed up by credible data or verified by an accredited third party.

Helpful Resources

- Cascale has released the first edition of the Higg Product Module in September 2020. This tool will enable companies to assess environmental impacts from materials to products and will help companies develop more sustainable products consistently across the industry. The second edition of the Higg Product Module, which covers the use and end-of-use phase, will be released in 2021.

- European Clothing Action Plan – Mapping Clothing Impacts

Intent of the question

This question intends to ensure companies are confirming and tracking the percentage of products that have environmentally preferred attributes/certifications. Developing a progressive sustainable products strategy will only be possible if a company understands and has visibility of its entire product portfolio and knows whether environmentally preferred attributes or certifications have been used by their finished goods/products suppliers.

Technical Guidance

- If you have answered “yes” to this question, your company has tracked the environmental attributes of more than 75% of your entire product portfolio.

- If you have answered “partial yes” to this question, your company has tracked the environmental attributes for 25-75% of your entire product portfolio.

- If you have answered “no” to this question, your company has tracked the environmental attributes for less than 25% of your entire product portfolio.

Guidance related to the table format

Please refer to the guidance as part of question 5.

Supply Chain: Product & Textiles

You will be asked to complete the information for each tier in the table. More information on definition of each tier is found in below sections.

Intent of the question

Knowing the specific address where production processes occur is the first step in understanding the environmental risks and impacts of your materials and products.

It is important to know the specific location of each facility that produces or processes materials and products, and the locations where the raw material inputs originate, as this is where some of the largest impacts occur.

In addition, knowing the geographical location would help you understand the sensitivity to harm or adverse environmental impacts that is linked to the sourcing region so that you can create action plans to mitigate these key impacts. For example, knowing what energy sources (coal, wind, solar or nuclear power) that are available in the region, whether the region has water risk or scarcity or if any important protected areas (such as ancient forests or areas of rich biodiversity) are part of your supply chain are all important regional information in order to determine the risk level.

Technical Guidance

Why does it matter?

The further down your supply chain, the more challenging it can be to obtain the exact locations of production facilities or areas where raw materials are grown or extracted. Typical reasons for these challenges include:

- Lack of direct contractual relationships with these entities.

- Many raw materials such as cotton, wool, and metals are commodities that are sold through brokers or traders on the open market.

- The supplier subcontracts work to other suppliers.

Understanding these relationships will help you know your supply chain, and will enable you to uncover risks and inefficiencies as well as opportunities. As an example, subcontractors used by your suppliers may operate in a manner that does not meet your standards and exposes your company to higher risks.

Keep in mind that the address or location you have for a supplier often does not identify the location of the facility producing the material or product. The address may be the location of the company’s headquarters or sales office, or an agent’s address. The supplier often produces the same product or material at various locations.

Getting started

The process of obtaining the addresses in the supply chain starts with listing all the suppliers that produce products and materials for your company. Work with your sourcing managers, sourcing agents, facilities managers, field staff, and buyers to build this list. Continue to work with these same people to reach out to the suppliers to obtain the addresses of all their production facilities that produce products or materials for you. Continue to work with the first layer of suppliers to identify their list of suppliers and so on.

Continue this work until you are able to identify the location of the supplier that produces the raw materials, such as the farm or mining operation.

Start the process by focusing on the suppliers that produce your high-volume products and materials. For each product, trace the flow of materials through the supply chain. Keep cascading along the chain until you reach the end: your raw material suppliers.

It is important to identify the address(es) of the actual facility(ies) that produces the product and material, and each of the suppliers down the supply chain, as this is the first step in determining the specific impacts of the materials and products you purchase. By knowing these locations you will then investigate the various impacts such as:

- Types, sources, and amounts of power used.

- Sources and amounts of water used.

- Wastewater treatment systems on site.

- Types and amounts of contaminants in the wastewater discharged.

- Types and amounts of air emissions.

- Environmentally sensitive areas near the facilities.

- Impacts to local communities.

- Local and county regulations that apply, etc.

The above information for each facility location can be obtained by using the Higg Facility Environmental Module (Higg FEM)

The descriptions of supplier tiers:

- Tier 1 Final product manufacturing and assembly (or finished goods production)

- Tier 2 Material manufacturing (or finished materials production)

- Tier 3 Raw material processing

- Tier 4 Agriculture and extraction

- Other tiers: E.g. wholesale/third party brands, chemical supplier

To better understand the supply chain tiers please review Supplier Network Diagram version 6.1

This work is licensed under a Creative Commons Attribution-Share Alike 4.0 International License.

Definitions:

- Finished Component Manufacturing: This refers to manufacturers that supply trims/accessories comprising the finishing components of an apparel, footwear and hard goods products. Examples are zippers, buckles, snaps, buttons, etc.

- Material Converter: An organization that coordinates between Tier 2, 3, 4 suppliers to develop finished materials to be used in the final products.

Guidance for Small and Medium sized Enterprise (SME)

From the perspective of conducting due diligence, all companies irrespective of size must know their supply chain in order to identify risks that prevent them from having full visibility and being able to assure customers of their responsible business conduct.

Due to their relatively small order quantities and minimal leverage in the supply chain, SMEs may oftentimes rely on business partners (sourcing agents) for the management of their supply chain. This kind of indirect sourcing is an information gap that poses significant risk (because most impacts occur in the manufacturing of products) and must be addressed. At the same time, the strength of SMEs also lies in their size. These companies tend to be more nimble/agile and can quickly react to any changes compared to larger corporations.

At the start of this journey of mapping your supply chain you will uncover many questions and uncertainties. You will also find that cascading down your raw material supply chain will take considerable time and effort. This is normal and to be expected. Having supply chain transparency is a long-term goal which requires support of key- stakeholders involved. To this point we encourage SMEs to engage in industry/sector initiatives such as the Sustainable Apparel Coalition to help implement collaborative solutions to this complex topic that one company alone cannot solve.

The following SMEs have publicly shared their insights on supply chain mapping and providing transparency:

Answer options

- To answer ‘yes’ for each supplier segment, your company must know the production locations for >75% of suppliers in the relevant tier.

- To answer ‘partial yes’ for each supplier segment, your company must know the production locations for 25 – 75% of suppliers in the relevant tier.

- When answering “no” for each supplier segment, this would mean that your company knows the production locations for less than 25% of suppliers in the relevant supplier tier.

Helpful Resources

- Explanation on supply chain tiers: Supplier Network Diagram version 6.1

- More information on Higg Facility Environmental Module

- Data Collection Sheet (Supply Chain) could be used to start listing your suppliers.

- The Outdoor Industry Association has helpful resources on understanding the subject of supply chain mapping. You will be able to access these through this page. In particular we would recommend reviewing the Getting Started Guide – Supply Chain Mapping and Textile & Textile Chemistry Supply Network.

- Agreement on Sustainable Garments and Textile: A Collaborative Approach to Supply Chain Mapping

Intent of the question

This question intends to encourage companies to publicly disclose their supplier list for the purpose of increased supply chain transparency. When companies publicly communicate about their supply chain, it ensures transparency and accountability to meet with key-stakeholders’ expectations, and gives consumers the option to access information on where the product is made, to help them make an informed purchasing choice.

Transparency also holds companies accountable to ensure that human rights are respected, and that working conditions and the environment are safeguarded.

Technical Guidance

Since the founding of the Sustainable Apparel Coalition, a core part of our vision has been to provide trusted and relevant information to all decision-makers, including consumers, so that they can decide how best to manage their impacts through what they purchase. Cascale encourages companies to commit to the fashion transparency pledge.

To answer this question:

- Review the Supplier Network Diagram version 6.1 to better understand the supply chain tiers. Cascale aligns with the definitions

- Please select the supplier segments/tiers that you have publicly disclosed and share the link to where the information can be found. In addition, you are requested to share how often you update the supplier lists and whether a link to the supplier’s environmental performance data has been shared (in addition to their location).

- In this current version it is not possible to choose between Agents, Trading Company or Licensees. When this supplier segment has been selected you may provide additional explanation of your answer through; the aforementioned public link to where the information can be found or share supporting documentation during verification.

Answer options

- To answer ‘yes’ your company must know the production locations for >75% of suppliers in both Tier 1 and 2.

- To answer ‘partial yes’, your company must know the production locations for at least 25 – 75% of suppliers in both Tier 1 and 2.

- Answering “no” means that your company knows the production locations for less than 25% of suppliers in either Tier 1 or Tier 2.

Helpful Resources

- Alliance for Corporate Transparency – the largest publicly available study on companies’ sustainability disclosures to date.

- Fashion Revolution

- Why Transparency Matters: https://www.fashionrevolution.org/about/transparency/

- A list of companies (including Cascale members) that publicly disclose their supplier list https://www.fashionrevolution.org/transparency-is-trending/

- Open Supply Hub (OS Hub) is an open-source map and database of global apparel facilities and their affiliation.

Intent of this question

This question builds on the questions 1-3 in the Management System section by evaluating how your company is addressing the environmental risks that were identified as part of your risk assessment process.

While it is possible to make progress in advancing sustainability without a formal program in place, establishing such a program enables a company to coordinate its efforts more effectively and to realize continuous improvement over an extended period of time.

Technical Guidance

Supply Chain segments: The definition of tiers has been explained in the guidance of the previous question.

Environmental Performance Program – Includes formal policies, strategies, manufacturer contracts, or action plans to improve the environmental performance of the company’s supply chain.

Answer options

- To answer ‘yes’ to this question, >75% of your suppliers are enrolled in your company’s environmental program.

- To answer ‘partial yes’ to this question, 25% to 75% of your suppliers are enrolled in your company’s environmental program.

- To answer ‘no’ to this question, less than 25% of your suppliers are enrolled in your company’s environmental program.

Helpful Resources

- To better understand the supply chain tiers please review Supplier Network Diagram version 6.1 This work is licensed under a Creative Commons Attribution-Share Alike 4.0 International License.

Programs that support improvements in environmental performance

Intent of this question

This question is designed to determine if the company has monitoring systems to verify suppliers involved in the production of goods are operating in compliance with local law.

This does not refer to the product or materials outputs themselves, but to the facilities, equipment, and processes which make them.

Technical Guidance

Value Chain definition: All activities involved in the creation, sale, and servicing of products to the end customer. This includes product development, manufacturing, logistics (inbound and outbound), company operations, distribution and customer support services (example repair programs).

Verifying compliance with your standards and local law at all tier levels within your supply chain requires a company to know all suppliers at each tier level and have established monitoring processes. It also requires your company to understand and manage the different legal requirements by geography within your supply chain.

Thus, this question may be favorably answered “yes” by multiple means, including a company’s oversight of a supplier’s internal means to manage such information, a company managing the information themselves or the use of third-party services.

Examples of different approaches that can be used:

- Companies can monitor their suppliers means to manage this activity by reviewing the facility responses to the following questions in the Higg Facility Environmental Module – Site Info & Permits section:

- Does your facility have a valid operating license, if required by law?

- Did your facility receive any government-issued environmental violation records for this reporting year?

- Please complete the following questions to provide details on your facility’s environmental permits requirements and compliance status.

- Verified Higg FEM scores should be more valuable than non-verified ones for this compliance aspect.

- Alternatively, companies may elect to use third-party organizations that understand and ensure supply chain legal compliance in addition to a deeper view into Environmental Health & Safety in tier 2 & 3.

- For managing the process for suppliers of finished products (tier 1), companies could utilize a qualified Environmental Health & Safety third party, provided that the supplier does not have chemical intensive processes such as laundry, garment dyeing, printing, etc. where a specialized third party (with Chemical specialty) should be used.

Note: Depending on the risk level and resources a company may have, third-party experts or organizations can offer on-the-ground support when evaluating supplier’s data. Having said that, enlisting the support of a third party should not be substituting a brand’s own efforts to continuously support the performance improvement of supply chain partners.

Answer options

- To answer ‘yes’ for each supplier segment, your company has confirmed the compliance for >75% of your suppliers in the relevant tier.

- To answer ‘partial yes’ for each supplier segment, your company has confirmed the compliance for 25 – 75% of suppliers in the relevant tier.

- When answering “no” for each supplier segment, this would mean that your company has confirmed the compliance for less than 25% of suppliers in the relevant tier.

Helpful Resource

German Partnership for Sustainable Textiles – Setting up an effective monitoring system for your company’s supply chain

In this question we will focus on the practices your company has implemented, to reduce or improve Energy and Water resource consumption that are affecting your supply chain partners.

Energy

15.1 Have practices been implemented to reduce energy use and Greenhouse gas (GHG) emissions in your company’s supply chain?

Water

15.3 Have practices been implemented to reduce water consumption in your company’s supply chain? Answer options: Yes/Partial Yes/No

Intent of this question

This question intends to confirm the practices or actions your company has taken to reduce resource consumption within your supply chain. For this question the Sustainable Apparel Coalition has identified key impact areas to be: Energy, Renewable Energy, and Water. There is an opportunity for companies to expand from this and explain other impact areas they have prioritized.

Technical Guidance

Companies should start by reviewing the Addressing Supply Chain Impacts guide which we have created to address each of the above key impacts, the document will outline the processes and options that are generally useful for brands and retailers to implement in partnership with their suppliers.

- In order to answer ‘yes’ to this question, the company can demonstrate actions have been taken to reduce resource consumption in all 3 key impact areas: renewable energy, energy and water.

- In order to answer ‘partial yes’ to this question, the company can demonstrate that actions have been taken to reduce resource consumption in one of the key areas of renewable energy, energy or water.

Helpful resources

Energy and Greenhouse Gas Emissions related to the supply chain

Supply chain related Greenhouse Gas emissions are categorized by the World Resource Institute (WRI) in their Greenhouse Gas Protocol as Scope 3 emissions

- Higg Facility Environmental Module – Energy Use & GHG section

- Companies setting emission reduction targets in line with climate science

- Common Objective – Energy

Renewable Energy

Water

Other resources

Chemicals Supply Chain

16.1.2 Has your company established a program aimed at improving chemicals management in the supply chain? Answer Options: Yes/Partial/Unknown

Intent of the question

To establish a clear indication of purpose and mission for the brand regarding chemical integrity. This question is an internal facing check on the robustness of the brand’s chemical management program (by a measure of what is or is not present), combined with a few key external expectations regarding supplier contractual expectations.

Technical Guidance

This question provides the foundation of the company’s commitment to a chemical integrity program. Its critical elements are:

- A corporate policy, approved by your company’s executive team and/or Board that underpins the commitment to the success of this program.

- Compliance with all applicable regulations or international norms (whichever is higher).

- Specific minimum requirements and best practices that go above and beyond applicable regulations.

- Requirements in manufacturer contracts that requires their suppliers and subcontractors to meet the goals of the program.

- Public disclosure including a description of your impact, effectiveness of managing impacts, and details pertaining to your program.

Much like the question “Have practices been implemented to reduce or mitigate chemical risk in its supply chain?”, this question cannot be measured simply in quantity, without considering quality and magnitude. A “Yes” response would be representative of ALL the critical elements in the Technical Guidance of this question–done adequately. Anything less would elicit at best a “Partial Yes” response. A “No” is essentially none of these, or none done well.

Specifically, the response should be assessed by:

16.1.4 Does your company have a means to confirm that suppliers at each tier of its value chain identify, manage and meet compliance with all applicable chemical use and chemical environmental regulations in their country/region? Answer options: Yes/Partial/Unknown

Intent of the question

This question is designed to determine if the company has the system in place to maintain continual oversight on the appropriate local, regional and national regulations which are applicable to the facilities who manufacture their materials and finished products. This does not refer to the regulatory compliance of product or materials outputs themselves–often geographically distant from the place of manufacture. This requirement is focused on the facilities, equipment, and processes which make the materials and products.

Technical Guidance

Understanding and managing the legal requirements of your suppliers is understandably a big ask of any company because identifying and tracking local laws in countries/regions where their supply chain exists can be a time consuming, difficult process. To be realistic, this question may be appropriately answered “yes” by multiple means. This includes having a direct oversight of their supplier’s internal SOPs to manage such information, the use of third-party services to provide the check, or a company (brand) managing the regulatory information themselves and using this as a basis for checking compliance.

Most importantly, companies can monitor their supplier’s means to manage this action by utilizing—where available and verified—responses to the following questions in the Higg Facility Environmental Module: (Facility demonstrates possession of:)

- Permits, Question 3 (table): Are permits required for specific chemical use and management? If yes, upload.

- EMS, Question 4: Does your site have a program or system in place to review and monitor environmental permit status and renewal (where appropriate) and ensure compliance?

- EMS, Question 5: Does your facility maintain a documented system to identify, monitor and periodically verify all laws, regulations, standards, codes, and other legislative and regulatory requirements for your significant environmental impacts?

Alternatively, companies may elect to use third-party organizations to satisfy this requirement. These service companies will most likely document and ensure supply chain legal compliance as an added benefit to the primary service of managing a broad set of EHS requirements for tier 2 & 3 facilities. Examples such as the bluesign system and OEKO-TEX STeP certification, or a highly qualified EHS audit firm with experience and expertise in materials manufacturing processes and the primary issues, are suggested options.

Brands should educate themselves on the scope and magnitude of the methodology for each 3rd party they are considering to determine the robustness of the option(s).

Depending upon how a company accomplishes the task, the answer may include strategies that have combinations of the following aspects. In all examples, the ability for a company to understand and manage this process is predicated on a high level of achievement in knowing their supply chain (see question #10 in Brand/Environment section on knowing supply chain):

- If a company monitors the required regulations on their own, records showing the applicable regulations as mapped against the complete view of their supply chain including the process to update such records and showing latest version of said records.

- If the appropriate questions of the FEM are utilized, review of the companies records for FEM coverage (verified) against their supply chain.

- If a third party is utilized, documentation that shows the chosen third-party participation and extent of the supply chain covered by the services would suffice.

Answer Options

All the above, at all Tier 1 facilities AND Tier 2 facilities would earn the ability to answer “Yes”, anything less than this (e.g., only T1 and sporadic T2), but greater than None of this, would qualify as “Partial Yes”.

The following questions relate to your company’s Product Restricted Substance List (RSL)

16.1.9 Has your company adopted and implemented a Product Restricted Substance List (Product RSL) or other lists of restricted chemicals for its products and the materials contained within them? Answer options: Yes/No/Unknown

Intent of the question

Establishing a Product RSL (This is often referred to simply as an RSL) is a very foundational action that establishes a set of restrictions or outright bans on substances which should not be found in finished materials or finished products. An RSL by itself does not constitute a chemical management program, however is an important step every company should take as part of their chemical integrity strategy.

This question establishes an initial platform from which a total RSL program may be further defined. The process of “adopting” an RSL is a first step. A complete RSL program a brand must go further than simply establishing a common document. A robust RSL program includes: a communication plan, a risk matrix to determine where such substances might be found in their range of products, a testing program, a remediation program (when problems are found), and other aspects in order to make the entire program more effective.

Technical Guidance

A company may adopt an established universal, global industry standard RSL, adopt one developed by another company, or develop their own version. It is highly recommended and a best practice to use an industry standard RSL to improve the tool’s completeness, relevance and drive overall supply chain efficiency. Examples of existing, widely-adopted, and industry-relevant RSLs include:

- AAFA RSL (American Apparel & Footwear Association):

- AFIRM RSL

- Bluesign RSL (minimum)

- (Note: the BSSL–also found here–is an RSL of sorts, however covers many substances not likely found in finished products)

- OEKO-TEX Standard 100 RSL

If answered yes or partial yes

- A copy of the current RSL shall be provided (if an industry standard one is utilized, simply a reference can be provided which indicates where the RSL can be found and acknowledgement that the company has in fact adopted it)

- For percent product coverage, the company should demonstrate the relevance of the RSL to the products and materials which are part of the company’s range. A reference to the Product Development questions 3 and 4, whereby the company must be able to indicate a YES or at least a PARTIAL YES to indicate that they understand all the materials and therefore which products are covered by the RSL.

- For percent of suppliers who are covered by RSL (9.1.2) a company must be able to first demonstrate that they have a view of their suppliers for each tier (Yes or Partial Yes to question 2 in this section for each of the respective tiers)

- Then the company should be able to demonstrate that the supplier has been informed of the RSL requirement, has acknowledged receipt, and agrees to comply with the requirement.

Note: In the case that the company is not in direct contact with a number of its tier 2+ and the tier 1 operates on behalf of the company for purposes of RSL compliance, a clear record of the communication to the tier 1 communicating the expectation should be provided to indicate any compliance above tier 1.

Improvement opportunities

- Best practice is to use an industry standard RSL where upkeep, maintenance, and communication is centrally managed instead of the brand/company taking on this responsibility itself.

- Best practice is to manage the chemistry on the input to the manufacturing facility (MRSL) instead of the output (RSL).

The following questions relate to your company’s Manufacturing Restricted Substance List (MRSL)

16.1.10 Has your company adopted and implemented a Manufacturing Restricted Substance List (MRSL) for its suppliers? Answer options: Yes/Partial/Unknown

Intent of the question

This question is intended to first determine if an MRSL has been established for the company, then assess the scope in which the company’s MRSL has been formally applied to the company’s supply network.

Unlike a Product RSL, which is targeted at chemistry contained within or on a finished material or product, an MRSL is intended to restrict or ban specific substances before they enter places of materials or finished product manufacturing. The theory is that if the restricted or banned substance never enters a facility, or the input of substances is managed down to acceptable levels, it will never leave the facility on, or in a material, or by way of an emission such as water, air, or waste.

Technical Guidance

To answer ‘yes’ to this question, the company must have documentation of their MRSL, the MRSL process and requirements across their supply chain, explicitly identifying the specific levels of the supply chain (tiers) covered by the protocol.

A company should be prepared to demonstrate coverage by showing documentation of formal outreach and sharing of expectations. This documentation could be included in a clearly defined management system protocol (likely a chemical management program), a Vendor Guide, individual product and/or policies, or all of the above. Records for statements of compliance (from suppliers) returned, including percentages of supply network who have responded, shall be reviewed.

Further, it should be recognized that some 3rd party certification schemes that screen chemical inputs to the manufacturing facilities who use chemistry, may also be considered as satisfying the requirements of a brand requiring MRSL. The specific certification body’s banned or restricted substances requirements for formulations, and the method of screening, should be closely reviewed to determine if they align with the company’s chosen MRSL (most frequently the ZDHC MRSL).

If all the above is in place and clearly applied to the Tier 1 & Tier 2 suppliers, then a company may answer “Yes” to this question. Anything less than this, and short of None of this, qualifies as a “Partial Yes”.

Wastewater

16.2 Have practices been implemented to reduce or mitigate wastewater in your company’s supply chain? Answer options: Yes/Partial Yes/No

Answer options

- In order to answer ‘yes’ to this question, the company can demonstrate that practices have been implemented to reduce or mitigate wastewater in the company’s supply chain tier 2 segment.

- In order to answer ‘partial yes’ to this question, the company can demonstrate that practices have been implemented to reduce or mitigate wastewater in the company’s supply chain tier 1 segment.

- When answered ‘no’ to this question, no practices have been implemented yet.

Packaging

Intent of the question

This question is intended to assess whether your company has a way of tracking at least the primary materials (by volume) used in its consumer packaging. This information is needed to build an understanding of the potential environmental risks and impacts associated with these materials. This question is also intended to ensure that your company has an accurate accounting of the packaging materials of the products you sell.

Technical Guidance

Definitions

- Primary materials are defined as the key materials used to make the final product. Primary materials are all the materials that, when totalled, represent at least 80% of the total material usage.

- Consumer packaging is defined as on-product packaging, labels, and retail packaging.

- On-product packaging: everything that is on a product and taken off before a consumer wears it (hangtags, fasteners).

- In-store Packaging: packaging for use in-store (e.g., including shopping bags, hangers, alarms, etc.) This excludes hangtags since that is part of the on-product packaging.

- Retail/e-Commerce Packaging: packaging that is designed specifically for e-commerce (poly bags, boxes, etc.)

- Definition of Foam: A solid “open cell” or “closed cell” foam material commonly used in packaging and footwear. Includes EVA, PE, and PU foam. More information can be found through Higg MSI on Higg.org platform

Answer options

- To answer ‘yes’ to this question, >75% of your total volume of primary materials (used in its consumer packaging) has been recorded in an inventory.

- To answer ‘partial yes’ to this question, 25-75% of your total volume of primary materials (used in its consumer packaging) has been recorded in an inventory.

- To answer ‘no’ to this question, less than 25% of your total volume of primary materials (used in its consumer packaging) has been recorded in the inventory.

Helpful Resource

A template has been created to support your company in tracking these materials. Please download the data collection sheet (packaging tab) from here.

Intent of the question

Similar to the previous question. This question intends to assess whether your company has a way of tracking at least the primary materials (by volume) used in its transport packaging as well as to ensure that there is an accurate accounting of the packaging materials associated with the transport packaging.

Technical Guidance

Transport packaging refers to all packaging items used to transport products (e.g., corrugated boxes, poly bags, pallets, shrink wrap, adhesive labels, etc.)

Answer options

- To answer ‘yes’ to this question, more than 75% of your total volume of primary materials (used in its transport packaging) has been recorded in an inventory.

- To answer ‘partial yes’ to this question, 25%-75% of your total volume of primary materials (used in its transport packaging) has been recorded in an inventory.

- To answer ‘no’ to this question, less than 25% of your total volume of primary materials (used in its transport packaging) has been recorded in the inventory.

Helpful Resource

A template has been created to support your company in tracking the packaging materials. Please download the data collection sheet (packaging tab) from here.

Intent of the question

This question is intended to understand whether your company has eliminated or reducing packaging materials in any of your channels or for any of your consumer packaging in the .

Technical Guidance

Lightweighting is a concept about using materials that are less heavy as a way to achieve better efficiency and handling.

Answer options

- To answer ‘yes’ to this question, your company can demonstrate that the company’s reduction program has helped eliminate or reduce consumer packaging materials.

- To answer ‘partial yes’ to this question, your company has included requirements for the elimination or reduction of consumer packaging materials in procurement contracts.

Helpful Resources

- EUROPEN is an EU packaging supply chain organization. The below report shares insights from ther member companies on how they have started to improve on their packaging use.

- REI’s Sustainable Packaging Guidelines

- Designing a Sustainable Packaging Program by Massachusetts Institute of Technology

- The Consumer Goods Forum Global Protocol on Packaging – pages 22-26 describes the calculation of environmental metrics for environmentally sustainable packaging

Intent of the question

This question is intended to understand whether your company has eliminated or reduced packaging materials in any of your channels or for any of your consumer packaging in the last .

Technical Guidance

Lightweighting is a concept about using materials that are less heavy as a way to achieve better efficiency and handling.

Cross-docking is a practice in logistics where products from a supplier or manufacturing plant are distributed directly to a customer or retail chain with marginal to no handling or storage time in between.

Answer options

- To answer ‘yes’ to this question, your company can demonstrate that the company’s reduction program has helped eliminate or reduce transport packaging materials.

- To answer ‘partial yes’ to this question, your company has included requirements for the elimination or reduction of transport packaging materials in procurement contracts.

Use & End of Use

- Yes: 50 Percent or more of faulty damaged products or unsold inventory

- Yes: 1-49 Percent of faulty damaged products or unsold inventory

- No

Intent of the question

This question is intended to understand whether the company has set up a solution or system to responsibly deal with faulty, damaged, unsellable or returned products and unsold inventory.

Technical Guidance

Companies are encouraged to put in place a reverse logistics system or systematic decision-making process to deal with faulty, damaged, unsellable or returned products and unsold inventory.

Companies should identify methods with the least environmental impact by avoiding the increase of waste to landfills, and air pollution caused by incineration.

Inventory should be distinguished between:

- Unsold or returned but in good condition.

- Inventory that is faulty or damaged but safe to reuse/recycle.

- Inventory that is unsellable, damaged, or contaminated in a way that makes it unfit for sale or recycling (for example, if chemical levels are non-compliant with company quality controls or legal limits, or contaminated with specific molds that make it unsafe to reuse or recycle).

The most preferred options, as long as they are environmentally responsible, are for companies to:

- Reuse/repurpose undamaged but unsold or returned inventory and materials.

- Non-contaminated but damaged stock should be repurposed or recycled wherever possible.

- Faulty or damaged goods that are not safe for reuse or recycling should be decontaminated wherever possible to facilitate recycling, or disposed of responsibly if necessary.

By prioritizing solutions for unsold and damaged inventory, and aiming for maximum reuse or recycling, this approach supports the transition to a circular economy and moves away from the linear approach of make, use, and dispose.

Helpful resources

- Ellen MacArthur Foundation – A New Textiles Economy

- Arc’teryx Birds Nest Project 2012

- The Renewal Workshop

Examples of third-party service providers

Deadstock materials, findings, trim, or unusable scraps

- Queen of Raw

- Excess Materials Exchange

Unsold inventory/good-quality returns

- Responsible excess inventory resale – charity model: TRAID (UK only)

- Responsible excess inventory resale – upcycling model: Looptworks

- Custom reverse logistics and excess inventory separation/placement: Parker Lane Group

- Returns optimization and excess inventory AI: Optoro

- Best practices for storing product in a manner that extends product life.

- Cleaning or washing products only as frequently as is necessary.

- Guidance on re-treating or re-finishing products to enhance and prolong applicable performance or aesthetic characteristics that are likely to extend product life.

- Low-impact dry cleaning or no dry cleaning.

- Low-impact product care guidance (e.g., where appropriate — washing garments at a lower temperature, line-drying or hang drying, using non-toxic detergents, avoiding bleach, etc.).

- Other

Intent of the question

This question is intended to assess whether your company provides guidance to customers on how they can care for products in a responsible manner. Customers may not be aware of the environmental impacts associated with caring for their products, so offering information can be an effective way of encouraging them to reduce any associated impacts. Providing this guidance can also help customers derive the maximum value from products by extending the life of the product. In some instances, responsible product care requires that customers have access to specific resources, such as cleaning kits, laundry bags, product treatments/finishes, etc.

Technical Guidance

To answer “yes” to this question, product care guidance must be made publicly available and easily accessible for consumers (e.g., through website, phone customer service, in-store printed materials, on-product labeling and/or trained staff).

Companies are encouraged to have an on-product care label for washing at lower temperatures where it makes the most sense and has the greatest environmental impact (example: environmental impact is higher for jeans than for undergarments).

Non-toxic detergents: such as those free of phosphate, Linear Alkyl Benzene Sulphonic Acid (LABSA) and Sodium Lauryl Sulphate (SLS).

Helpful resources

Brand (Social & Labor)

This section should be completed by companies that are responsible for product creation which includes design & development, manufacture and distribution of their own/private label brands.

Licensees:

Companies that are licensees (holder of a license to use a trademark) and are responsible for product creation as per the previous paragraph may also complete this section to evaluate their own sustainability practices and performance.

Licensors:

Companies that make product creation decision for licensees to execute should include those licensee business streams in their own Brand section reporting.

Companies that request their licensees to complete their own Higg BRMs should exclude those licensee businesses from their own Brand section reporting to avoid double counting.

Steps in the OECD due diligence process that are addressed in the Brand – Social & Labor section

Step 1. Embed Responsible Business Conduct into policies & management systems

Step 2. Identify & Assess Adverse Impacts in Operations, Supply Chains and Business Relationships

Step 3. Cease, prevent or mitigate adverse impacts

Step 4. Track Implementation and Results

Step 6. Provide for or cooperate in remediation when appropriate

Product

Social/human rights assessment tools or methodologies (e.g. Social Life Cycle Assessment, geographical or commodity risk analysis, analysis through stakeholder consultation) could support your company’s efforts to identify and assess these impacts. Please note that this question focuses on your individual raw materials, not on your products.

Intent of the question

This question intends to ensure that the company has a robust understanding of the salient social/human rights impacts that are associated with the raw materials supply chain.

Technical Guidance

This question builds on the Management System section wherein you have identified your salient social risk(s) related to materials manufacturing (please review the risk(s) you have identified in Management System section question 2 and 3).

For companies at the start of the journey, there are 4 steps they can take to begin assessing social/human rights impacts in the raw materials supply chain.

For companies that are further along in the assessment of human rights impacts in the raw materials supply chain, they may prefer to update parts of their assessment (outlined as part of the 4 steps) if/when new information is brought to their attention that would change their evaluation of impacts and risks.

Step 1: Identify & track materials by volume.

Identify all your raw materials by volume, country of origin and use this tracking sheet if helpful.

Step 2: Identify the salient risks of adverse human rights impacts associated with the materials.

The result of step 1 is a list of raw materials by volume and country of origin.

This list will serve as a basis for the second step activity on identifying the salient risk(s) of adverse human rights impacts associated with your raw materials use.

Companies do not need to start from scratch, when identifying the salient human rights risks, and can rely on publicly available information such as:

- OECD has identified the following common risks for the garment and footwear sector:

- Child Labor

- Discrimination

- Sexual Harassment and sexual and gender-based violence

- Forced Labor

- Non-compliance with minimum wage laws

- Occupational health and safety (e.g., work-related injury and ill health)

- Violations of the rights of workers to establish or join a trade union and to bargain collectively

- Wages do not meet basic needs of workers and their families

- We have created a guide companies can consult which describes the social risks identified in the Higg BRM assessment and where they may occur.

- As a reminder, you can review the guidance on how to determine salient risks (as explained in the management system section) from here.

Step 3: Evaluate the human rights risk for each material on the basis of where your material is manufactured.

Now that you have identified the salient human rights risks for your company to focus its efforts on, it is time to evaluate these risks in the context of the materials you have used.

Companies can evaluate the risk on the basis of:

- Material type: How much risk to adverse social/human rights impact could be reduced through your material procurement.

- Manufacturer/Supply Chain: Understand and measure the social/labor conditions of your manufacturer (specific impacts against the risks) by using the Higg Facility Social & Labor Module (FSLM)

- Sourcing country/location – The geographical and commodity risk that are involved where the material is grown/produced and manufactured.

- The leverage your company has to reduce the risk (does it require an industry approach or can an individual company make the change).

Step 4: Develop an action plan and set targets to track progress

- Engage internal and/or external stakeholders to identify how your company can mitigate and/or reduce the adverse social/human rights impacts on the material and supplier level through a sustainable materials strategy. Key internal stakeholders are for example senior management, product designers and developers, Research & Development and staff responsible for sourcing / procurement.

- Based on the discussions, develop an action plan and SMART targets that specifies how the company and respective staff will source more sustainable materials (in order to reduce or mitigate their adverse impacts) in the next 1-3 years.

Important Note: All companies, regardless of their company size or degree of leverage with their suppliers, have a responsibility to know the environmental impacts of its materials use. However, the specific steps that a company would take may vary based on their leverage. For example, a company could collaborate with other companies through a multi-stakeholder initiative to increase their leverage with suppliers.

Helpful resources

- Evaluating commodity risk: Responsible Sourcing Tool

- Evaluating country risk: MVO Risk Checker (this comprehensive database managed by CSR Netherlands is particularly worthwhile for Small to Medium Enterprise to review).

- https://www.mvorisicochecker.nl/en/home (homepage)

- https://www.mvorisicochecker.nl/en/start-check (risk checker based on product/service and country of origin)

- Evaluating garment and footwear sector risks: OECD Responsible Supply Chains in the Garment and Footwear Sector

- OECD has shared guidance (pages 105 – 152) on the process of identifying, preventing and mitigating key sector social/human rights risk.

- Global Compact – Assessing Human Rights Risks and Impacts

- Solidaridad – Developing Sustainable Materials Strategy

- Social Life Cycle Assessment – A social life cycle assessment (S-LCA) is described as a social impact (and potential impact) assessment technique that aims to assess the social and socio-economic aspects of products and their potential positive and negative impacts along their life cycle.

- European Commission: Social assessment of raw material supply chains

- PRé-sustainability: Handbook for Product Social Impact Assessment (can be applicable to material stage as well)

- S-LCA methodological sheets

- UN Environmental Program (From page 22 onwards)

How this will be verified

Documentation required

To answer this question, please ensure you have the following evidence:

- A list of any standards, industry tools, resources, or documents used by company to guide the identification of risks, impacts, and opportunities.

- Copies of documents produced in determination of salient risks, impacts, and opportunities. Any documentation should use credible data sources, or data that has been verified by an accredited third party.

- Examples of documents: Social Life Cycle Analysis (S-LCA) data; geographical or commodity risk analysis using credible third-party tools or datasets; analysis, benchmarks or recommendations from expert organizations.

- Stakeholder consultation (including external expert participants) to map out the likely risks and impacts for your material types.

Interview question to ask:

- Please describe the process or methodology that led to an appropriate understanding of the salient risks, impacts, and opportunities for the raw materials supply chain

- Suggested document upload for this question: Documentation of the social/human rights impacts assessment of materials (e.g. Social Life Cycle Assessment, geographical or commodity risk analysis, analysis through stakeholder consultation)

Intent of the question

This question is intended to ensure companies have a robust understanding of the social/human rights impacts associated with the manufacturing and use of their products, so they can set strategies and targets accordingly, to improve on these identified impacts. This question also intends to support your internal process to identify and prioritize the salient social/human rights risks and impacts holistically across your product portfolio.

Technical Guidance

Social/human rights assessment tools or methodologies (e.g. Social Life Cycle Assessment, geographical or commodity risk analysis, analysis through stakeholder consultation) could support your company’s efforts to identify and assess these impacts.

Please review your answer to question 1 in this section and include the finished goods manufacturing as well as the use phase of the products within the scope.

To answer ‘yes’ to this question, your company must have an analysis, assessment, or study (carried out in the last five years) over a single product, that includes one or more of the following:

- Social/human rights risks and impacts based on the manufacturing and the use phase of key product categories. Any analysis, assessment or study should be backed up by credible data or verified by an accredited third party.

- Documentation of materials and finished goods production processes collected through production records.

- Specific opportunities to address social risks or impacts within the stages of product design and development.

Helpful Resources

- PRé-sustainability: Handbook for Product Social Impact Assessment (can be applicable to material stage as well)

Intent of the question

This question intends to ensure that companies are confirming the total products that they source with social/human rights certifications.

Technical Guidance

The previous questions were focused on the materials stage, whilst this question covers the manufacturing — from materials through to the product.

Developing a progressive sustainable products strategy will only be possible if a company understands and has visibility of the entire product portfolio; this includes knowledge of whether attributes or certifications have been used by their finished goods/products suppliers.

Answer options

- To answer ‘yes’ to this question, more than 75% of your company’s sourced products have a social/human rights certification.

- To answer ‘partial yes’ to this question, 25 – 75% of your company’s sourced products have a social/human rights certification.

- When answering “no” to this question, less than 25% of your company’s sourced products have a social/human rights certification.

Supply Chain: Product & Textiles

Intent of the question

It is essential for companies to share their social/human rights policies before entering into a business relationship with any manufacturer. By doing so, a manufacturer will have a clear understanding of the expectations and requirements of doing business with you. This also fosters a collaborative business relationship built on transparency and trust from the beginning.

Technical Guidance

Please refer to this resource which explains the steps to define and embed social/human rights policies within your company.

A policy is a written commitment that outlines the expectations and requirements your company has on a certain topic. A policy standardizes the step-by-step approach in the company’s ways of working and of its staff.

Companies often have policies in place for topics such as product quality, payment.

A policy statement should:

- Provide clarity to staff and external stakeholders about what the company expects regarding human rights.

- Be tailored to the company’s business model, industry and human rights risks.

- Be developed in consultation with relevant experts and stakeholders.

- Be approved at the most senior level of the business.

- Be communicated to internal and external stakeholders.

- Be made publicly available.

- Policy statements once finalized should be embedded within the organization to ensure internal processes and procedures align with the policy. Companies should take the following actions to embed commitments throughout ways of working:

- Define roles and responsibility for the policy within the company

- Develop procedures to support implementation of the policies, including revising existing procedures if necessary

- Create accountability throughout all senior levels of the company and functions

- Conduct training within the company to help everyone understand expectations

- Conduct specialized training with key roles responsible for implementing the policy

- Integrate into the company’s rewards and incentives programs to prevent the company from incentivizing the wrong behavior

Communication between brand and manufacturing partner(s)

The company’s social/human rights policies should be shared with suppliers prior to entering into a business relationship and should be re-communicated to them at minimum once a year.

When new information about emerging social/human rights risks are brought to the company’s attention, this should prompt the company to consider how this will impact its understanding of risks, as well as how it will impact policies and strategies going forward — e.g. increases in migrant labor, changes in labor laws, entering new sourcing markets and countries.

Communication to suppliers may take a number of forms: through in-person supplier meetings/summits, corporate website, email. However, in all cases, information should be maintained and communicated in a way that is relevant, accurate, current, clear, and user-friendly and that enables intended users to access more information.

Not only should companies share the policy with their manufacturers, but they should also publicly communicate this to any stakeholders who would like to know more.

Helpful resources

Examples

- G-Star Social & Labour Guideline

- H&M Human Rights Policy

- Business & Human Rights Resource Centre – Overview on Company Policy and Statements

- Shift, Oxfam and Global Compact Network Netherlands—Doing Business with Respect for Human Rights: A Guidance Tool for Companies

- Designed to equip companies with practical advice and real-life examples that help to translate the UNGPs into action

- United Nations Global Compact—A guide for business: Guide on How to Develop a Human Rights Policy

Intent of the question

This question builds on the questions in the Management System section by evaluating how your company is addressing the social/human rights risks that were identified as part of your due diligence process.

While it is possible to make progress in advancing sustainability without a formal program in place, establishing such a program enables a company to coordinate its efforts more effectively and to realize continuous improvement over an extended period of time.

Technical Guidance

As a first step, many companies establish a policy defining its social/labor expectations for suppliers and a process to monitor and remediate identified non-compliances. The scope of your supply chain program may be limited to Tier 1 suppliers but ideally extend to your full supply chain depending on your company’s leverage, number of suppliers and supply chain visibility.

In addition, your company may have identified risk areas where additional action is needed to prevent or mitigate potential impacts as part of your human rights due diligence risk assessment. Companies are expected to act on identified risks and track efforts to assess the effectiveness and measure improvements.

Answer options

- To answer ‘yes’ to this question, over 75% of all your suppliers are in-scope of your company’s social/human rights program.

- To answer ‘partial yes’ to this question, 25-75% of all your suppliers are in-scope of your company’s social/human rights program.

- To answer ‘no’ to this question, less than 25% of all your suppliers are enrolled in your company’s social/human rights program.

Helpful Resources

- Higg BRM Guidance: Understanding Human Rights Due Diligence

- Higg BRM Guidance: Conducting Human Rights Risk Assessments. This overview defines what salient risks are, the different types of risks assessments you can conduct as part of your company’s human rights due diligence and guidance for conducting an assessment.

- Higg BRM Guidance: Track & Communicate Progress: This document explains what best practice is for tracking and communicating progress based on the UN Guiding Principles and OECD Due Diligence guidance.

- Higg BRM Guidance: Setting Baselines and Targets: This document explains amongst others how to define targets and track social performance commitments as part of your management systems.

Intent of the question

This question intends to confirm that the company has a system or complaint mechanism in place where any affected stakeholder could raise their questions and concerns directly to the organization.

Technical Guidance

The core purpose of conducting due diligence is to avoid harm from occurring in the company’s proprietary business operations and supply chain. When a company has identified that they have caused or contributed to adverse human rights impacts. They should also provide for, or cooperate in legitimate processes towards, the remediation of these impacts. The mechanism to support companies to come to that understanding, and to receive information on whether they have caused or contributed to adverse human rights impacts, is a grievance mechanism.

The OECD Due Diligence Guidance encourages companies to “commit to hearing and addressing complaints that are raised through legitimate processes regarding activities in their supply chain.” There is a wide range of legitimate processes that companies may choose to participate in, for example, companies may:

- Establish a grievance mechanism by which trade unions, civil society, and impacted parties can raise a complaint with the company itself regarding its actions in its supply chain.

- Engage in multi-stakeholder initiatives (MSIs) that provide supply chain grievance mechanisms (e.g., as a member) or agree to enter into mediation with any MSI that raises a legitimate complaint against the company.

- Enter into agreements with trade unions, for example through global framework agreements, to establish a process by which trade unions can raise complaints to the company that its practices have caused or contributed to harm in its supply chain, for the purpose of providing remedy.

- Agree to enter into mediation with the OECD National Contact Points (NCPs) when the NCP has determined that the issue is bona fide under the procedures of the OECD Guidelines, see below for more information. Refer to page 101 of the guidance.

Definition of Grievance Mechanism: a formal, legal or non-legal (or ‘judicial/non-judicial’) complaint process that can be used by individuals, workers, communities and/or civil society organizations that are being negatively affected by certain business activities and operations.

Complaints submitted through the grievance mechanism should be material and substantiated and assert that the company has caused or contributed to an impact in its supply chain.

A safe, effective grievance mechanism should be designed according to the eight criteria of an effective grievance mechanism (as outlined by the United Nations Guiding Principles on Business and Human Rights (UNGPs)

Criteria | Definition |

1. Legitimate | Enables trust from the stakeholder groups for whose use they are intended, and being accountable for the fair conduct of grievance processes |

2. Accessible | Known to all stakeholder groups for whose use they are intended, and providing adequate assistance for those who may face barriers to access |